Why money is so important?

Money is a reward

Money is what you receive when you help someone else achieve their goal

Payday is simply reward day. You are rewarded for spending your best hours of each day, your energy, and knowledge helping your boss reach specific goals. They paid you for this.

Money is very important. You cannot live in your home without it. You cannot provide for your family without it. Your automobile costs money. Your clothes cost money. Most marriage counselors observe that the number one cause of divorce is financial conflict.

Therefore, if money is so important like this we must know or understand important tips that can help us grow our finance

In this article, we explore 7 simple steps or nuggets identified in this 91-year old book and how you can employ these steps in diligently building your wealth. The book titled "The Richest Man In Babylon" written by George Samuel Clason in 1926 is undeniable personal finance classic

Here are the nuggets:

1. Start saving 10% of your income

“For every ten coins, thou placest within thy purse take out for use but nine. Thy purse will start to fatten at once and its increasing weight will feel good in thy hand and bring satisfaction to their soul”.

2. Control thy expenditures

“What each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary. Confuse not the necessary expenses with thy desires”.

3. Make your money work for you

“The gold we may retain from our earnings is but the start. The earnings it will make shall build our fortunes. Learn to make your treasure work for you. Make it your slave. Make its children and its children’s children work for you”.

4. Protect your wealth

“The first sound principle of investment is security for thy principal. Is it wise to be intrigued by larger earnings when thy principal may be lost? I say not. The penalty of risk is a probable loss. Study carefully, before parting with thy treasure, each assurance that it may be safely reclaimed. Be not misled by thine own romantic desires to make wealth rapidly”.

5. Build or rent a home you can comfortably afford

“I recommend that every man own the roof that sheltered him and his. Nor is it beyond the ability of any well-intentioned man to own his home. To own his own domicile and to have it a place he is proud to care for, putteth confidence in his heart and greater effort behind all his endeavours”

6. Plan for retirement

“The life of every man proceedeth from his childhood to his old age. Therefore do I say that it behoves a man to make preparations for a suitable income in the days to come, when he is no longer young, and to make preparations for his family should he be no longer with them to comfort and support them.”

It is not early to start saving for that retirement life you dream of.

7. Invest in yourself

“That man who seeks to learn more of his craft shall be richly rewarded. The more of wisdom we know, the more we may earn. Cultivate thy own powers, to study and become wiser, to become more skilful, to so act as to respect thyself. Thereby shalt thou acquire confidence in thyself to achieve thy carefully considered desires”

In conclusion, you must discipline to save and invest

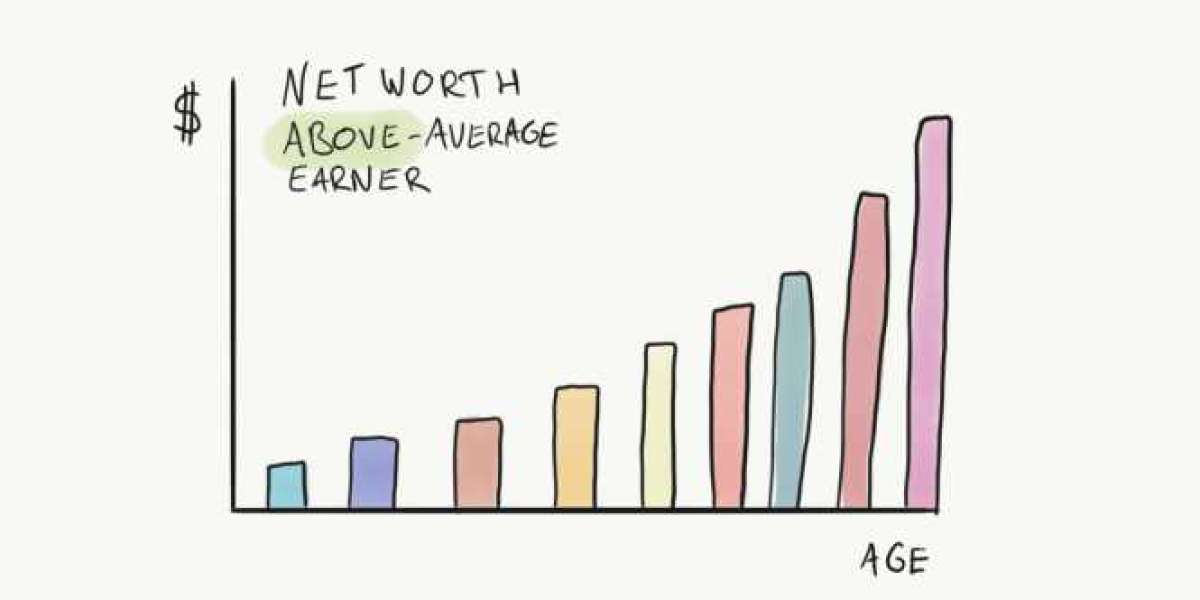

We are all limited by the number of years we have to be able to run around actively. A twenty-year-old today probably has another 20–30 years of active working life left. This is to say, as we age, the physical labour we can offer reduces. This period is when we can set the foundation of our wealth.

The moment you have decided to create your wealth then you should take action towards making it happen by starting a dedicated savings account. Irrespective of the amount you decide to save periodically, your savings should be automated to make it easier to achieve discipline and consistency. You should also invest your money in opportunities like mutual funds and other investments

Jonah Ekeh 43 w

Good delivery