What is your own financial plan? If you had asked me a few years ago, I would have laughed it off and said, "I'll put it off till tomorrow." That was a bad decision. It's no surprise that my net worth was substantially smaller at the time.

There's a good possibility you'll never be wealthy if you don't have a personal financial strategy. The average millennial earns between $40 and $50K per year and owes between $20 and $40K in school loans.

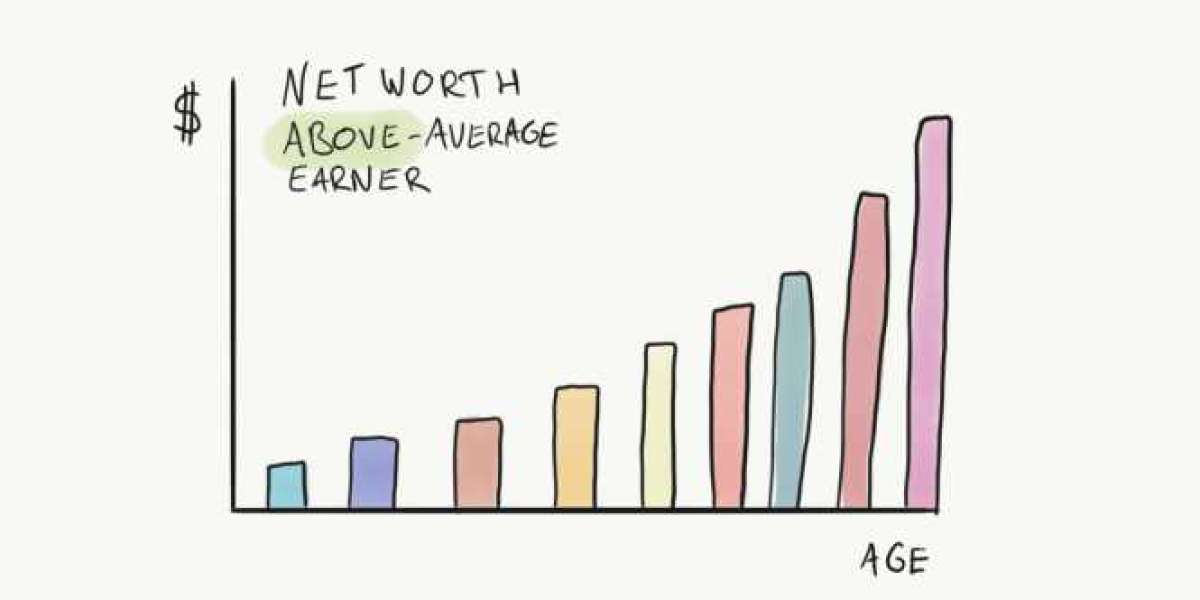

The high-achieving millennial, on the other hand, can make up to 7X more than the average. People of all ages are affected in the same way. The gap between ordinary and above-average earners is enormous.

I became serious about money after I realized this. But I didn't focus on getting more money, which is a common error. We always believe that additional money will solve all of our problems.

But we must abandon the notion that additional money would solve all of our issues. We'd be better off devising a strategy that enables us to better manage our finances—this alone will enable us to rise above the typical earner. To accomplish so, I've devised a set of five money rules for myself.

1. Have fewer desires

Here's some sound advice: Making money takes longer than spending it. You put in tens of thousands of hours to earn a certain sum of money. Then you may spend it all on a new automobile, a luxury vacation, a watch, or whatever else you choose.

Isn't that something we're all aware of? Despite this, we continue to spend money as if it were nothing. I know your grandfather probably told you this, but the simplest method to expand your bank account is to not spend it all.

2. Understand How The Economy Functions

When is the interest rate most likely to rise? When does it start to rain? What exactly are bonds? What exactly is inflation? When do you expect to see inflation? How long does the market cycle last?

Why do economies tend to crash? What exactly is debt? Who is in charge of printing money? What is the purpose of printing money?

I could go on and on, but you get the idea. You don't have to be an economist to do this (I certainly don't). But do yourself a favor and read a book like Burton Malkiel's A Random Walk Down Wallstreet.

3. Stay out of personal debt

Personal debt, more than anything else, eats away at your net worth. To be clear, I do not believe that borrowing money is a bad thing.

It's often essential and wise to take on debt if you want to establish a business or undertake large real estate deals. However, we must exercise caution while taking on debt. There are rules to it, just like there are to investment.

One thing is certain: never take out a loan to purchase a car, electronics, or anything else that will depreciate in value.

However, before you get into debt for more complicated activities like growing/starting a business, investing in real estate, or even your schooling, consider twice. It's important to remember that borrowing money isn't free.

4. Make the most of your money by saving as much as you can.

This is self-evident at this point. Avoid debt and save as much as you can if you don't have any desires. There's a reason personal finance is named that.

Your financial plan is determined by your age, personality, location, education, and experience, among other factors. A person who lives in Manhattan is unlikely to be able to purchase an apartment. It's pricey, and renting would be a better option.

5. Develop a long-term plan

This post is intended for those who do not wish to pursue a career as a professional investor or trader. We invest for the long term, not to profit today or even in a year's time.

My investment strategy is long-term oriented. But it means I'll have to work today in order to pay my bills. How do you go about doing that? This is your short-term plan.

My personal short-term money strategy focuses on honing my talents and diversifying my sources of income. I put a lot of money into my own education because I understand that having more talents means having more money.

Begin Right Now

These guidelines aren't just about making more money. Yes, having different revenue streams is critical. However, before you concentrate on making more money, work on improving your skills in dealing with the money you already have.

The most essential question you can ask yourself now is: Am I capable of creating value?

If the answer is no, make it a top priority to change it to yes. Determine how successful people are compensated. That isn't something you can learn from a single article. Read books, research investors, try new things, speak with affluent people, and so on.

Jonah Ekeh 44 w

Good