Hybrid cryptocurrency exchanges are here to usher in a new era of streamlined cryptocurrency trading by combining the best features of traditional centralized and decentralized platforms. These systems attempt to combine the advantages of both centralized and decentralized markets by incorporating the speed and simplicity of CEXs with the safety and autonomy of DEXs. As a result, hybrid crypto exchanges are cutting-edge trading systems that address the shortcomings of both existing exchange models.

Cryptocurrency Markets and Their Varieties

Exchanges for trading cryptocurrencies in a safe and user-friendly environment are an essential part of the digital asset ecosystem. To assist you discover the ideal option for your trading needs, we'll look at the pros and cons of several different types of cryptocurrency exchanges.

Distributed Trading Platforms (DEX)

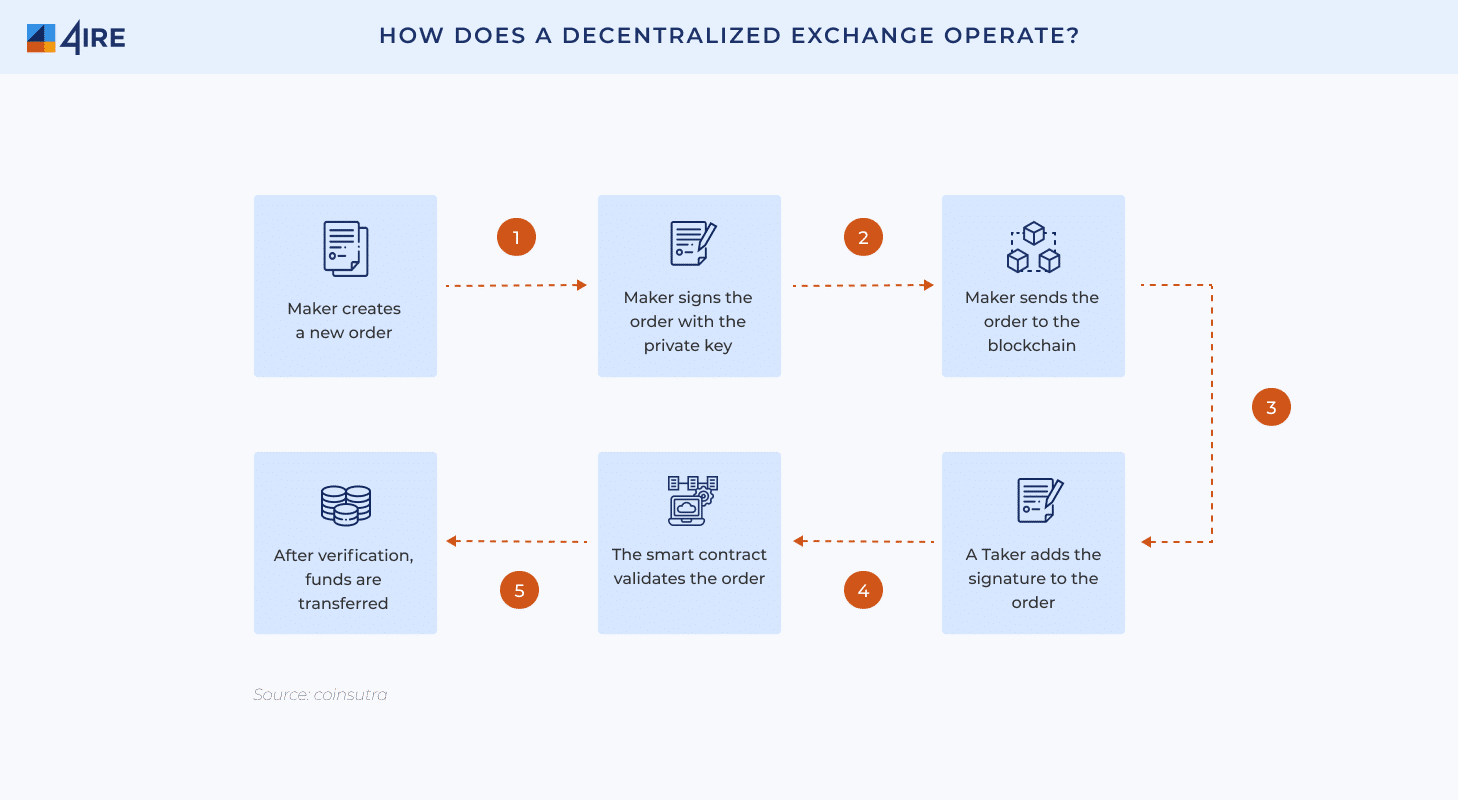

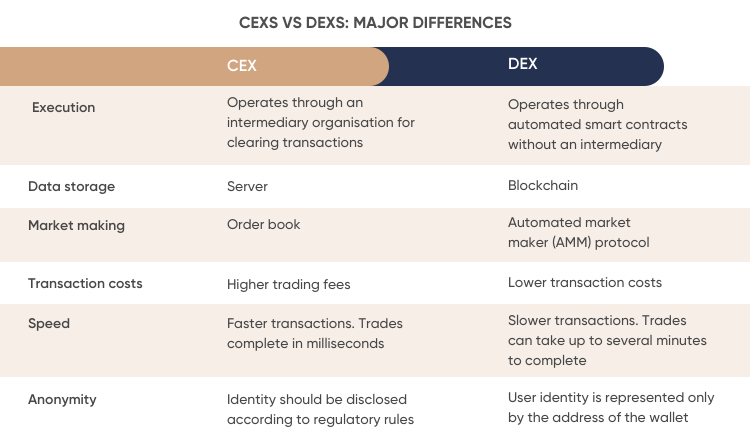

Decentralized exchanges (DEXs) are trading platforms for cryptocurrencies that are not under the control of one particular entity. Users can buy and sell cryptocurrencies on these marketplaces without giving up their private keys because they are built on top of public distributed ledger infrastructure like the Ethereum network. DEXs function by enabling users to engage with smart contracts, as opposed to centralized exchanges, where trades are conducted via an order book managed by the exchange. These "smart contracts" eliminate the need for middlemen by automatically executing trades between users depending on predefined circumstances.

Read More: Learn the ins and outs of cryptocurrency trading.

Decentralized cryptocurrency exchanges provide the highest levels of user freedom and security but at the sacrifice of usability and transaction speed. There are three distinct forms of decentralized trading platforms:

Directly linked order books This DEX runs on an entirely stored and managed order book.

in a distributed ledger. Due to the processing resources needed to maintain the order book on the blockchain, this method, while providing a high level of security, can be slow and expensive.

Distributed ledgers These marketplaces function with an order book that is kept in a non-blockchain location, most frequently a centralized server.

While this method outperforms on-chain order books in terms of speed and efficiency, it does so at the expense of some of the security features made possible by blockchain.

AMMs, or electronic market makers, These DEXs use a mathematical algorithm to price assets in real-time, taking supply and demand into account.

are gaining recognition because they are simple to employ and don't call for the maintenance of a separate order book. The decentralized nature of DEXs, in my opinion, provides a very high level of security. From what I've seen, though, there are downsides as well, like a lower

lack of customer service, confusing interfaces, little trading volume, and low liquidity. I also think there must be no one in charge of the market, as this has led to greater market volatility and the opportunity for fraudulent operations. The CEX Model of Centralized Trading The centralized exchange (CEX), which is one type of cryptocurrency exchange, is one such entity.

The platform operator is in charge of managing the order book and the cryptocurrency trading for fiat money or other digital assets. There are many benefits to using a cryptocurrency exchange (CEX), including high trading volume, significant liquidity, and convenient access to many different cryptocurrencies. Additionally, complex trading features are available to consumers.

instruments and functions of the unified platform, such as margin trading and sophisticated charting choices. But there are downsides to using a CEX, as my experience has shown. The security of your funds may be at risk if you put your faith in an exchange operator and they lose control of the platform. In my experience,

that regulatory scrutiny and compliance requirements can be challenging for consumers, and that transaction costs can add up quickly.

The potential of a hybrid crypto exchange platform to address the limitations of more conventional trading venues is evidence of the industry's forward momentum. Salomon Maza's Artwork To begin trading on a CEX, customers must first open an account and fund it with either digital currency or fiat currency. Exchanges are then

carried out by a matching engine that pairs together purchasers and sellers. For every deal that goes through, the exchange takes a cut (expressed as a percentage of the entire amount traded). Binance, Coinbase, and Bitfinex are just a few instances of well-known CEXs. Binance's high volume and low costs have made it a popular exchange.

an intuitive layout that's easy to utilize. However, Coinbase became well-known for its robust safety measures, insurance safeguards, and straightforward mobile interface. Margin trading and liquidity swaps are just two of Bitfinex's many cutting-edge trading capabilities. Users should take the following precautions when utilizing a centralized exchange:

Don't put in more cryptocurrency than you can afford to lose. Two-factor authentication and cold storage wallets are two of the best ways to keep your funds safe. To further minimize legal ambiguity, it is important to investigate the platform's regulatory compliance.

Intermediary Markets

Hybrid cryptocurrency exchanges have emerged as a solution to the drawbacks of both controlled and decentralized crypto trading platforms. They take advantage of the best of both worlds, combining the convenience and safety of centralized exchanges with the privacy and scalability of decentralized ones.

Hybrid Cryptocurrency Exchange Characteristics

Since there is no longer a need to place assets in the hands of a custodian, user control over this money is a crucial aspect of hybrid exchanges. Because digital assets stored in wallets are linked to trustworthy smart contracts, traders can interact directly with these assets.

Safe money transfers. Because of its decentralized nature, users can conduct their financial dealings in complete secrecy. Hybrid exchanges additionally follow in the footsteps of their centralized counterparts by including an accessibility feature. They are not only easier to navigate for beginners, but they also tend to have friendlier atmospheres.

having readily accessible help and direction for customers. In addition, they have higher liquidity than their decentralized counterparts, allowing users to purchase and sell assets quickly whenever they need to. Finally, hybrid exchanges frequently provide additional cutting-edge features such as fiat integration, complex APIs, and Atomic Swap capacities,

facilitating the simple and direct trading of different kinds of tokens between users. These exchanges are the next generation of crypto trading markets that will connect the established financial sector with the emerging DeFi sector.

Advantages of Using a Cross-Platform Crypto Exchange

To attract customers, hybrid cryptocurrency exchanges provide perks from both the centralized and decentralized worlds. These platforms provide a streamlined, integrated trading environment by skillfully combining the benefits of blockchain technology with real-time service access. The user retains custody and control, which is a major advantage of hybrid exchanges.

of their property, free from the control or interference of outsiders. This decentralization improves the safety and anonymity of financial dealings without breaking the rules governing digital currency. Hybrid exchanges are unique because they avoid the security risks associated with hot wallets. They prefer instead

Users' digital wallets are safer in cold storage since they are not connected to the internet. Hybrid exchanges are characterized by their rapidity and openness, which lead to simple transactions. Because of this, they are a great choice for cryptocurrency investors all around the world. In conclusion, hybrid platforms' scalability is a prime

hypothetical future crypto exchange center that would do away with the scams that plague other decentralized networks. A hybrid cryptocurrency exchange promotes a trustworthy, highly functional, and internationally available platform for exchanging cryptocurrencies.

The Dangers of Using Cross-Platform Cryptocurrency Traders

However, traders must be informed of the hazards involved before using such sites. Regulatory ambiguity is a major threat when dealing with a hybrid crypto exchange. Since the platforms themselves exist in a legal void, there may be no set guidelines on how they should be used.

to fulfill a set of regulations. This may threaten investors' ability to stay in compliance with the law and their wealth. Security issues are another major threat. Hot wallets are particularly risky for hybrid cryptocurrency exchanges since they may hold both cash and coins. Additionally,

These markets might not have the same safety protocols as centralized ones or established banks. Hybrid exchanges carry the additional danger of high transaction fees. Investment returns for traders can be negatively impacted by the possibility that these platforms charge more fees than centralized or decentralized exchanges. Furthermore,

Investors run the risk of having their assets and digital currencies stolen or lost if they trade on unregulated exchanges. Finally, the anonymity provided by decentralized exchanges may not be present in a hybrid exchange. The personal and financial information of investors is vulnerable because of this lack of privacy. Traders need to grasp the big picture

of hybrid cryptocurrency exchanges and their possible dangers. Users' investments and financial security may be jeopardized due to these dangers. That's why safety measures like two-factor authentication and cold storage are so important, along with using a reliable platform.

Can You Give Some Instances of Hybrid Cryptocurrency Markets?

At the time of writing, there aren't many well-known hybrid cryptocurrency exchanges, although a few noteworthy initiatives have emerged.

Qurrex

Brokers, high-frequency traders, institutional investors, and arbitrageurs can all find what they need on Qurrex, a cutting-edge hybrid cryptocurrency exchange. To fulfill orders from its users, this system uses both on-chain and off-chain protocols.

Read More: How to Profit from Binance Blockchain Technology

An ECN is an electronic communication network that instantly fills buy and sell orders. In addition to its comprehensive API, fiat connectivity, aggregated order book, and trading facility for ERC-20 tokens, Qurrex also offers institutional-grade security, robust liquidity, high transparency, and 24/7 multilingual technical support.

Eidoo

Each Eidoo account is tied to a smart contract on the Ethereum blockchain, which makes it an interesting alternative to traditional methods of hybrid exchange. Your Eidoo account is private since only you have access to it and can see the money in it. With the exchange's built-in Atomic Swap feature, customers may effortlessly trade hundreds of ERC-20 tokens without relying on any other parties to conduct their transactions. Though these platforms show promise, it is important to do your research (DYOR) before participating with them because they are still relatively new to the industry. Knowing the basics of the project and the risks involved is essential before committing any money to it.

Impact of Hybrid Trading Platforms

Hybrid exchange systems have the potential to become important nodes in the future of bitcoin trading because of their inherent scalability. Investing in cryptocurrencies is becoming more appealing as their popularity grows. Hybrid exchanges are ushering in a new era of transparency, accountability, and enhanced security in the Bitcoin market.

From where I sit, hybrid exchanges are more than just places to buy and sell; they are also driving forces behind a paradigm shift in the way digital assets are understood and used. Because they solve problems with centralized and decentralized systems, they could have a major impact on the future of the cryptocurrency industry. An exciting new development in the world of cryptocurrencies, they promise to make transactions safer, faster, and more widely available.

Jonah Ekeh 44 w

Wonderful