Overview

Bitcoin mining is the process by which new bitcoins are created and transactions are verified on the Bitcoin network. Miners use powerful computers to solve complex mathematical problems, which validate transactions and add them to the blockchain, the decentralized ledger that records all Bitcoin transactions.

When miners successfully mine a block, they are rewarded with a certain number of newly minted bitcoins, in addition to transaction fees paid by users. This reward acts as an incentive for miners to continue their operations and secure the network.

However, Bitcoin mining profitability is influenced by several factors. One crucial aspect is the cost of electricity, as mining requires significant computational power and consumes a substantial amount of energy. Additionally, the mining difficulty, which adjusts every 2,016 blocks (approximately every two weeks), plays a significant role in determining profitability. Higher mining difficulty requires more computational power, thus increasing energy costs.

Read More: Bitcoin Gains 3% Over Debt Ceiling Agreement

In your query, you mentioned that miners are forced to liquidate new coins due to declined profits. In general, declining profitability can occur due to various factors, such as:

- Increasing competition: As more miners join the network, the competition for block rewards and transaction fees intensifies, reducing each miner's share of the rewards.

- Mining difficulty adjustments: If the network's total computational power increases significantly, the mining difficulty will also rise, making it harder to mine new blocks. This can result in decreased profitability if miners cannot keep up with the increased costs.

- The volatility of Bitcoin prices: Bitcoin's value can experience significant price fluctuations, impacting mining profitability. If the price decreases significantly, miners may find it less profitable to continue mining.

To cover their operational costs, such as electricity and equipment maintenance, miners may be compelled to sell a portion of the newly minted bitcoins they receive as rewards. This selling pressure can potentially impact the overall market by increasing the supply of Bitcoin and putting downward pressure on its price.

- Due to lower profit margins, miners are selling off freshly generated Bitcoin.

- Recent data show that profits have been dropping.

- When the Bitcoin price drops below $28,000, sellers gain traction.

According to a report published by Matrixport on Friday, Bitcoin miners may be to blame for the recent selling pressure the top cryptocurrency has been under. As the mining business grows more competitive, machines built prior to 2022 have a harder time turning a profit. Because of this, miners have been selling their newly created cryptocurrency, contributing to the market's gloomy mood.

MATRIXPORT claims that Bitcoin miners are selling off freshly mined coins since their profit margins have shrunk. Machines manufactured prior to 2022 are finding it difficult to turn a profit in the current market environment. It's #BITCOIN #MINERS #BTC

According to Matrixport, a cryptocurrency service provider, narrowed profit margins (in recent weeks) have prompted miners to unload all newly produced assets. According to the report, mining has become competitive and unprofitable as a result of the constant growth in BTC miner difficulty.

It is the measure of how easily Bitcoins can be mined by miners. This week, the metric reached a new all-time high. Meanwhile, Matrixport noted that, based on the current state of input costs and expected revenue from sales of such devices, they are unlikely to turn a profit before 2022.

The decline in mining profitability

Over the past year, the mining industry's profitability has plummeted. Since the crypto market's peak in late 2021, the hash rate has dropped by 82%, according to the Hashrate Index. However, it seems that a few mining companies are still willing to risk investing in the sector. CleanSpark bought new mining gear at a discount to take advantage of the market.

Solving Mining Problems

The mining industry has experienced significant earnings decreases over the past year, yet many companies continue to grow. CleanSpark, a Bitcoin mining firm based in the United States, just bought 12,500 Bitmain equipment.

The company needed the equipment to increase its mining output, so it spent money on it before the end of the year. The timing is also unfortunate since miners have been under intense pressure as BTC difficulty has reached new heights. The corporation is probably expecting profitable possibilities in the forthcoming sessions, in addition to taking advantage of reductions to acquire the units.

Read More: FinFinity Invest Full Review: Is FinFinity Legit or Scam?

Value of Bitcoin

Due to declining profits, miners must sell their assets now, rather than wait for prices to rise. As a result, people are now less bullish on Bitcoin. The dominant cryptocurrency's fight against the unknowns remained below the $28K price range. At the time of writing, it has a market value of $27,163.89, according to Coinmarketcap.

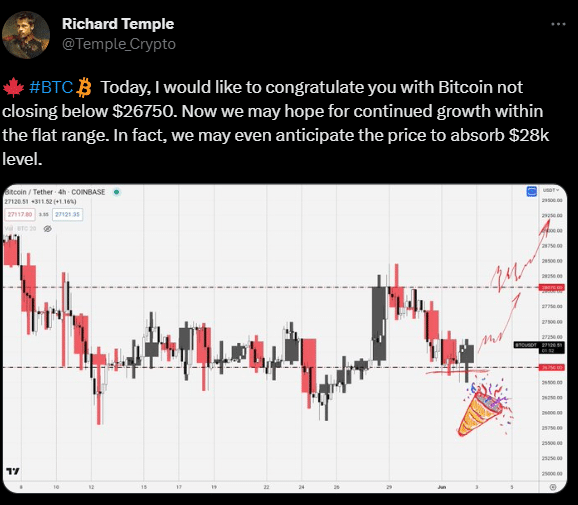

Crypto enthusiasts remain optimistic despite ongoing headwinds to Bitcoin's price appreciation. Since Bitcoin avoided a close below the pivotal $26,750 level, Crypto Temple stated that it may continue growing. The expert thinks the top asset can get above the $30,000 barrier.

? #BTC I'm writing to congratulate you on the fact that Bitcoin did not drop to a closing price below $26750 today. We may anticipate stable growth from here on out. We may estimate a price tag of around $28,000.

Conclusion

In conclusion, Bitcoin mining is the process by which new bitcoins are created and transactions are verified. However, mining profitability can fluctuate due to factors such as increasing competition, mining difficulty adjustments, and volatility in Bitcoin prices. When mining profits decline, miners may be forced to liquidate some of the newly minted bitcoins they receive as rewards to cover their operational costs. This can potentially impact the overall market by increasing the supply of Bitcoin and putting downward pressure on its price.